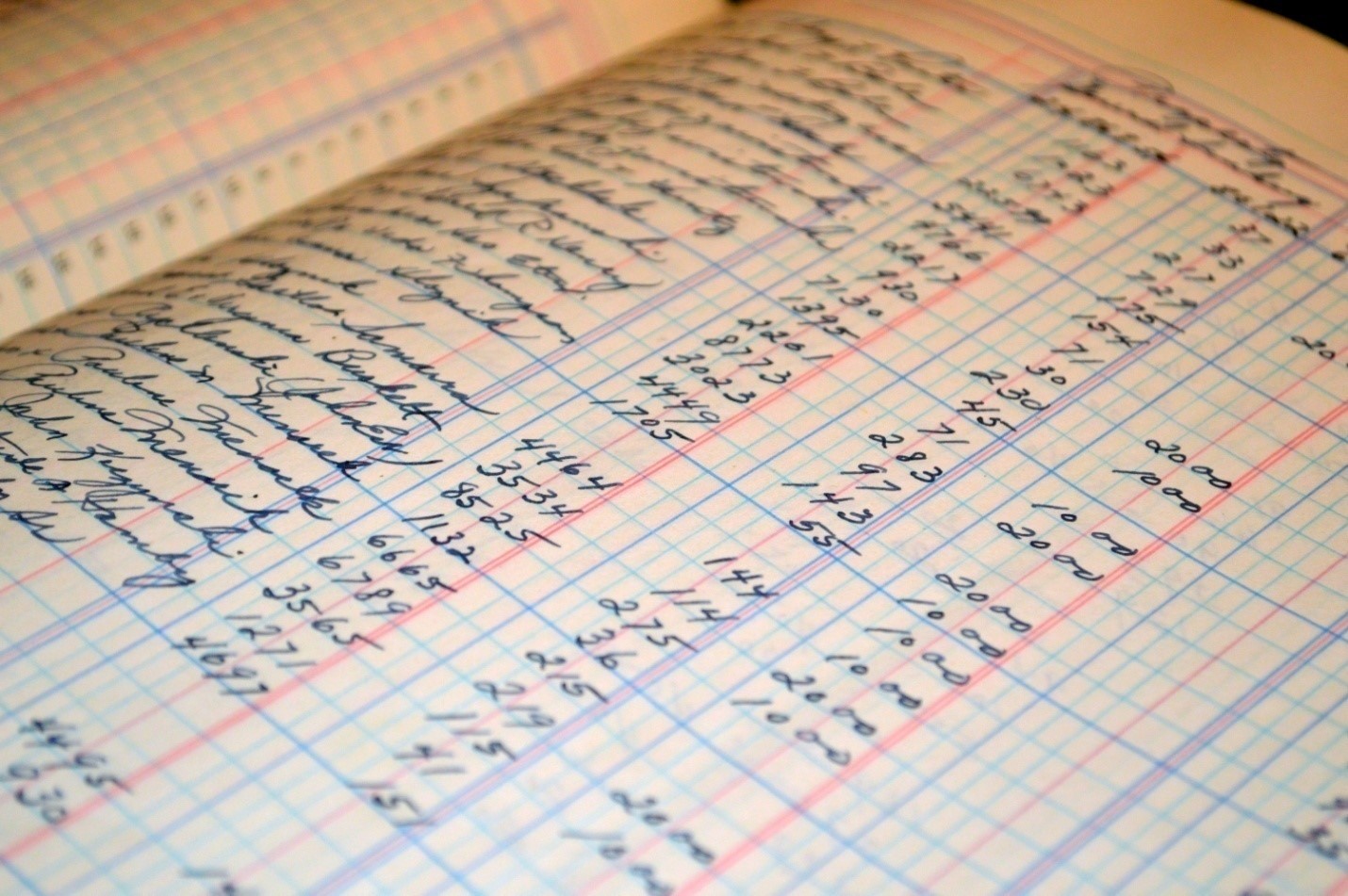

However, any business, be it small or large scale, use balance sheets. The businesses require balance sheets to measure the financial stance of the company at a given time. In other words, the classified balance sheets help organize various items on the balance sheet.

It helps make the information easier to understand and read. The organized formats are helpful for the managers if they want to make decisions without having to dig and sort through the information.

Additionally, you may come across times when confusion may occur due to a lack of standardization in the balance sheets.

Classified balance sheets are helpful if you want to see different kinds of information under various subcategories. In simple terms, we can say that the major items like liabilities, assets and shareholder’s equity, and much more can be further sub-categorized in the balance sheet.

The reason why organizations prefer this is because it becomes easy for them to read the sheet. If you look at the classified balance sheet even for the first time, then it is sure you’ll not face any problem doing so.

Traditional balance sheets lack distinct classifications between the different things as they have only two sections for liabilities and assets.

While as we have already mentioned earlier, a classified balance sheet easily divides up the assets into different categories like long-term assets, intangible assets, property, investments, current assets, and fixed assets.

Just like this, the classified balance sheets quickly divide the company’s liabilities into categories like equity, long-term liabilities, and short-term liabilities.

Objectives of Classified Balance Sheet

Table of Contents

• Objective of the classified balance sheet is to analyze and understand the financial position of where the business stands. Classified balance sheets are ascertaining the nature and amount of the liabilities pretty quick

A classified balance sheet can make you understand the change of trends in liabilities and assets. It can Ascertain the position of assets in paying for current liabilities. You can get help in understanding the profit and loss trends of the business.

These sheets are also helpful to understand prepaid and unpaid expenses easily. In other words, you can understand the debt position of the company very quickly

Advantages of the Classified Balance Sheet

Classified balance sheets offer a crystal clear yet crisp view of the business to anyone. Therefore you can get an easy calculation of the ratios.

It also instils trust and confidence in the creditors and investors. Regulators can find it easy to analyze the financial health of the company with classified balance sheets.

Common classifications of balance sheets

Even though there is no format set for the classified balance sheet, but management can classify what is essential for them and the stakeholders.

However, some of the common classifications you can find on the classified balance sheets are below:

Assets

In the balance sheet, the term asset represents both short-term and long-term assets. However, you can break it further into 5 different assets:

Current Assets

Current assets can be converted quickly in cash, and you can use them to pay for the near-term liabilities. The assets that come under this category can easily convert into cash within one year or one operating cycle.

When you list the assets on the balance sheets, the most liquid assets are the ones that you can convert easily into cash.

Long-term investments

The liabilities include purchasing land or funding to expand the plant, redeeming funds from the insurance policies, and investments from the other entities.

Plant, Property, and Equipment

In this category, the assets like machinery, land, and buildings that companies buy come. These assets must be used only for business operations.

Intangible assets

The meaning is simple; it means those assets which do not have physical existence. Copyrights, goodwill, patents and similar items are an example for such assets.

Other assets

This category has all those assets which do not come under any category like the special long-term receivables.

Liabilities

Here are the liabilities that are classified in the following categories:

Current liability

These are the types of liabilities that include getting mature for the payment or liquidation within a year. In other words, the company can easily maintain current assets to pay for the current liabilities.

Long-term liability

These are the financial obligations of a business that are due for more than a financial year—for example, bank loans, deferred taxes, and mortgage notes. There might be few cases where some of the long-term could come under the partially long-term and current.

In the current liabilities, the principal amount of loan is due for the next year is put, and the rest of the amount is put under the long-term liabilities.

Equity

The equity classifications of the financial statements are dependent on the kind of business. Usual types of business are corporations, sole proprietorships, and partnerships.

You cannot state a single capital account in the sole proprietorship. On the other hand, it can help maintain a separate capital account for each partner.

Difference between unclassified and classified balance sheet

Many large businesses and organizations wanting to balance the sheets. They need to go for the detailed and classified sheets. Many organizations have a significant number of accounts.

Therefore if the balance sheet is an unclassified one, it can increase confusion. In the other words, it can lead to the management making poor decisions.

Format of the sheet

Above all, if the balance sheet is a classified one, then it is a must that you show the assets first. The first head should always be the current assets like; investments, properties, plants, equipment. Intangible assets must follow later.

After the liabilities, assets, and several other sub-classifications show, it includes the long-term liabilities, current liabilities, and the owner’s equity.

It is a given for any balance sheet that the total assets must be equal to the total liabilities and the owner’s equity.

Conclusion for Classified Balance Sheets

In conclusion, when it comes to the balance sheet classification, it varies by industry, and thus it could be different from the classifications as shown above.

Take an example; the manufacturing companies will have more equipment and plants than a service firm.

However, you can even adopt the classifications system, so if you do remember, apply it consistently. Always remember that a classified balance sheet is always helpful than an unclassified one.